Retro Review: Casio BF-80

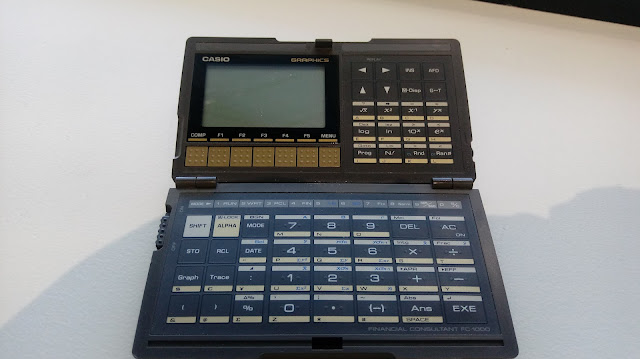

A folding calculator with easy-to-calculate finance prompts.

Quick Facts

Model: BF-80 (Easy Banker Financial)

Company: Casio

Years: 1985 (production run is probably the late 1980s)

Type: Finance

Batteries: 1 x CR-2016

Operating Modes: Chain

Number of Registers: 2 User registers: M, Kin/Kout

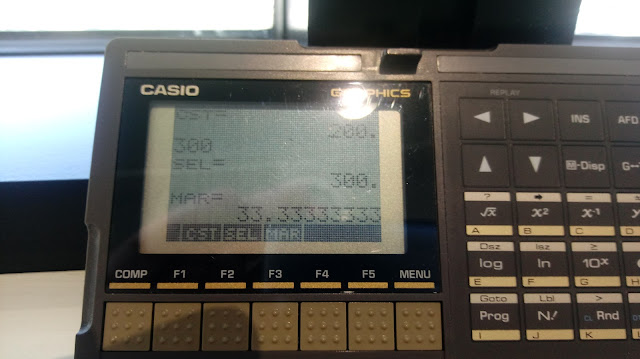

Display: 2 lines

Features

The BF-80 is a dual-leaf calculator. On the left side, you have a regular four-function calculator, including memory functions, percent, and the square root function.

On the right side is where all the financial functions the BF-80 are located:

[ Kin ]/[ Kout ]: The BF-80's other user memory register. Unlike register M, there is no register arithmetic.

[ HMS ]/[ <HMS ]: Convert decimal to/from hours-minutes-seconds. Use the [ HMS ] key to enter parts of time.

Example: Add 3.5 hours to 11:30:00

11 [ HMS ] 30 [ HMS ] [ + ] 3.5 [ = ]

Result: 15°0°0 (15:00:00)

[ DATE ]: The date key leads two of my favorite functions of all time: days between dates and calculating a future date. The format is yy - mm - dd (no dashes for 21st century dates). Years are entered as four digits, from 1901 to 2099.

For most, if not all, calculators, the cash flow convention is not used.

INST-FV: Calculates the future value of an annuity. Interest rate is entered as periodical rate. Note that deposits are made at the beginning of each period (annuity due). The INST indicator turns on.

Example: I pay $500 a month in an account that pays 5% interest for 10 years.

[ INST FV ] (INST indicator is on)

PMT? 500 [ ENTER ]

i%? 5 [ ÷ ] 12 [ = ] [ ENTER ]

n? 10 [ ÷ ] 12 [ = ] [ ENTER ]

FV= 77964.641

Pressing [ INT ] gives the interest earned: 17964.641.

CMPD-FV: Calculates the future value of a lump sum (present value). The CMPD indicator turns on, and INT gives the accumulated interest.

CMPD-PV: Calculates the present value of a future lump sum (future value). The CMPD indicator turns on, and INT gives the accumulated interest.

Both CMPD calculations use this equation:

FV = PV * (1 + i%)^n

LOAN-PMT: Calculates the monthly payment of a loan due at the end of each month. The loan is to paid without a balloon payment. The LOAN indicator turns on.

PV?: amount to be financed

i%?: annual interest rate

m?: number of monthly payments

Example: What is the monthly payment of $8,293.00 loan with 6% interest over 6 years?

[ LOAN PMT ] (LOAN indicator is on)

PV? 8293 [ ENTER ]

i%? 6 [ ENTER ] (no dividing by 12 in LOAN mode)

m? 6 [ × ] 12 [ = ] [ ENTER ] (still enter the number of months)

PMT = 137.43896

Pressing [ INT ] gives the accumulated interest paid on the loan: -1602.6051

LOAN-BNS: Calculates the bonus payment of a separate (side) loan given the number of bonus payments and it's cycle.

k = number of bonus payments

d = number of months to the first bonus payment

PV = bonus loan amount

i% = annual interest rate of the bonus loan

Example: What is the payment of a bonus loan of $4,412.00 with 3% interest. The firs bonus cycle is every 3 months from the loan date, with 15 bonus payments.

[ LOAN BNS ] (LOAN indicator is on)

PV? 4412 [ ENTER ]

i%? 3 [ ENTER ] (annual rate, like LOAN-PMT)

k? 15 [ ENTER ] (number of bonus payments)

d? 3 [ ENTER ] (number of months prior to the first bonus payment)

BNS = 328.21123

Pressing [ INT ] gives the accumulated interest: -511.16857

I guess that this is for loans where payments are due every few months instead of every month.

The Percent Key

The percent key on the BF-80 works like most Casio calculators with a percent key.

To add a percent: n [ × ] p [ % ] [ + ]

To subtract a percent: n [ × ] p [ % ] [ - ]

To find a percent ratio: part [ ÷ ] whole [ % ]

Percent change: new [ - ] old [ % ]

A Neat Calculator - An 1980s Version of a Smartphone App

For it's time, the BF-80 offers calculator with quick, prompting calculations for the on-the-go business and finance student or profession. Today, in the 2020s, the calculator of this time definitely would be a smartphone app.

Surprisingly buying a BF-80 was incredibly reasonable.

Coming up:

July 11 - July 15, 2022: TI-58 and TI-59 Week

Next Regular Blog: July 10, 2022, then July 23, 2022

Eddie

All original content copyright, © 2011-2022. Edward Shore. Unauthorized use and/or unauthorized distribution for commercial purposes without express and written permission from the author is strictly prohibited. This blog entry may be distributed for noncommercial purposes, provided that full credit is given to the author.