Casio fx-991CW: Generating Graphs

But Wait, the fx-991CW is Not a Graphing Calculator!

Technically, this is correct. We cannot generate graphs of the Casio fx-991CW calculator itself. But through the magic of the QR code, we can use that to generate graphs that appear on our smart phones.

What is needed:

(1) QR Reader. It does not have to be the official Casio EDU+ app, any QR reader app should do.

(2) A smart phone or device that can read QR codes.

(3) Your fx-991CW calculator. I believe that these instructions can apply to the fx-991EX as well, however, the instructions presented today are specific to the fx-991CW calculator.

The fx-991CW has storage for up to two functions: f(x) and g(x).

Steps

Step 1: Determine the number of functions you want to graph. You may either graph f(x) alone, g(x) alone, or both f(x) and g(x). To define functions, press the [FUNCTION] button.

Step 2: Press the [HOME] button, and select the Table app.

Step 3: Choose the number of functions to be evaluated. Press the [ TOOLS ] button, select Table Type, press [ → ], and select from f(x)/g(x), f(x), or g(x). Remember that contents of f(x) and g(x) are not retained when the calculator is turned off.

Step 4: Now we need to give the range. Press the [ TOOLS ] button, select Table Range, and then press [ → ]. Give a start value, an end value, and step. In terms of the graph, the value of step isn’t that important. Think of the start value as Xmin (minimum x value) and the end value as Xmax (maximum x value). Once you are satisfied, scroll down to Execute and either press [ EXE ] or [ OK ]. A table is generated.

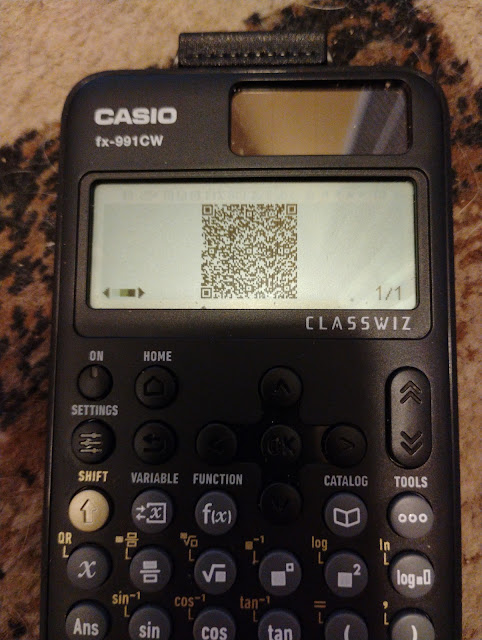

Step 5: Next, while the table is shown, generate a QR code by pressing [ SHIFT ] [ x ] (QR).

Step 6: Grab your smart phone or device with your QR reader app open. Scan the QR code. A successful scan will give you a link to the classpad.net website. Some camera apps will read QR codes and give direct access to the link as well, neat!

Step 7: Click on the link and you will see the graph generated. At this point, you can clear the QR code off the calculator by pressing either [ EXE ] or the back key.

I took the following pictures with my smart phone. It’s a challenge to get pictures in a room in a house with two dogs and three cats…

Eddie

All original content copyright, © 2011-2025. Edward Shore. Unauthorized use and/or unauthorized distribution for commercial purposes without express and written permission from the author is strictly prohibited. This blog entry may be distributed for noncommercial purposes, provided that full credit is given to the author.

All posts are 100% generated by human effort. The author does not use AI engines and never will.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)